LATHAM, N.Y., Jan. 06, 2020 (GLOBE NEWSWIRE) -- Plug Power Inc. (NASDAQ: PLUG), a leading provider of hydrogen engines and fueling solutions enabling e-mobility, received an order at the close of 2019 from a Fortune 100 customer for hydrogen fuel cell deployments across their distribution network over the next two years. This contract, valued at more than $172 million, is for Plug Power’s GenDrive fuel cell power, GenFuel hydrogen fuel, storage and dispensing infrastructure, and GenCareaftermarket service and support.

The global total available market for material handling is currently valued at $30 billion. Plug Power’s turnkey hydrogen and fuel cell solutions are attractive in high utilization environments, where they have a distinct advantage as compared to batteries. Hydrogen fuel cells are adopted to increase productivity, lower operational costs and reduce greenhouse gas emissions. Plug Power customers have reported a 15% productivity increase, and savings per year greater than $1 million in sites with approximately 200 forklift trucks.

Expansions with material handling customers like that announced today, combined with developing sales channels and continued growth in the European market are key drivers for achieving Plug Power’s $1B plan for gross billings in 2024.

Plug Power’s CEO Andy Marsh comments, “The material handling industry remains our core growth market in the near-term. This sizable contract signifies continual market validation to customer’s rapidly moving material handling business thus far. We commend this customer for its leadership in hydrogen and fuel cell adoption throughout the logistics business.” Marsh continues, “Coupling this growth with already unfolding market expansion in stationary power and on-road electric vehicles well positions Plug Power to achieve our $1B gross billing goal for 2024.”

Plug Power, the leader in deploying hydrogen and fuel cell systems into broader logistics markets, has deployed more than 30,000 fuel cell units into commercial applications. The company has built more than 80 hydrogen stations and, as the largest user of liquid hydrogen, consumes more than 24 tons daily. Plug Power’s manufacturing facility for the GenDrive and GenFuel products is its headquarters in Latham, New York.

SDC SmileDirectClub News - lawsuit dropped. 20% Shortquote. Könnte jetzt anlaufen. +5,8% 8,26$ derzeit.

Update: eingestoppt zu 8,25$ nach nur kleinem intraday Pullback.

https://finance.yahoo.com/news/plaintiffs-drop-class-action-claims-002000202.html

und

"Teledentistry pioneer SmileDirectClub today announced plans to increase its international expansion by introducing its clear aligner therapy to Germany in early 2020. The U.S.-based SmileDirectClub will open multiple SmileShops across the country, further expanding its doctor-directed remote clear aligner therapy in the European Union."

https://finance.yahoo.com/news/teledentistry-pioneer-smile-direct-club-130010576.html

Update SDC : Exclusiver Deal mit Walmart +8% BMO 9,12$. Shortquote immer noch 22%. ![]()

TUI Hebel sold. Risikoreduktion. Gewinne bis ca. +45%

SDC SmileDirectClub News - lawsuit dropped. 20% Shortquote. Könnte jetzt anlaufen. +5,8% 8,26$ derzeit.

Update: eingestoppt zu 8,25$ nach nur kleinem intraday Pullback.

https://finance.yahoo.com/news/plaintiffs-drop-class-action-claims-002000202.html

und

"Teledentistry pioneer SmileDirectClub today announced plans to increase its international expansion by introducing its clear aligner therapy to Germany in early 2020. The U.S.-based SmileDirectClub will open multiple SmileShops across the country, further expanding its doctor-directed remote clear aligner therapy in the European Union."

https://finance.yahoo.com/news/teledentistry-pioneer-smile-direct-club-130010576.html

Update SDC : Exclusiver Deal mit Walmart +8% BMO 9,12$. Shortquote immer noch 22%.

wieso wollen die ausgerechnet nach germany? hier bekommt doch jeder eine ordentliche kieferorthopädische behandlung für überschaubare zuzahlung, wenn er sie braucht.

SDC SmileDirectClub News - lawsuit dropped. 20% Shortquote. Könnte jetzt anlaufen. +5,8% 8,26$ derzeit.

Update: eingestoppt zu 8,25$ nach nur kleinem intraday Pullback.

Update SDC : Exclusiver Deal mit Walmart +8% BMO 9,12$. Shortquote immer noch 22%.

wieso wollen die ausgerechnet nach germany? hier bekommt doch jeder eine ordentliche kieferorthopädische behandlung für überschaubare zuzahlung, wenn er sie braucht.

Ich schätze möglicherweise ähnlich wie mit Hörgeräten/Hörhilfen.

Hörgerät 5400€, Kasse zahlt 2060€. Kosten 3340€.

Hörhilfe exemplarisch 20€-200€ bei Amazon oder vertrauensvollem Chinesen. Das reicht vielen Betroffenen.

Ansonsten frag mal die IR und nicht hier ;).

ZEN etabliert sich über wichtigen EMAs am 80$ Widerstand. Nachhaltiger Break bald möglich.

YUM Brands kauft HABT.

https://finance.yahoo.com/m/e5d609e2-8c80-30c0-90e7-179a152b3271/taco-bell-parent-yum-brands.html

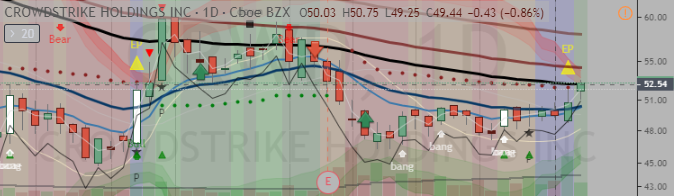

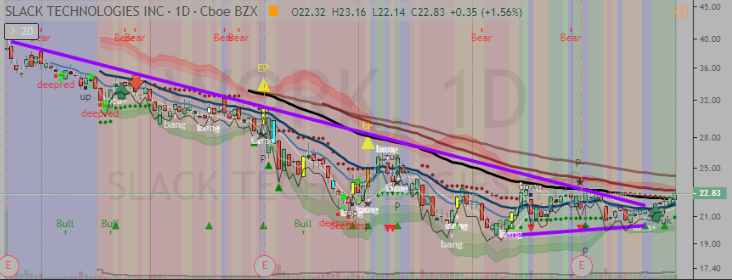

WORK Slack 21,86$ kleiner Teil long eingestoppt nach loca+Candle.

Update: WORK Trade startet mit +3,5% positiv, über EMA50. High der Range zuletzt um 23,3-23,5$ muss nun geknackt werden.

Update: WORK über EMA50/65. Könnte Widerstand bei 23,3$ sehr bald raus nehmen. +3,8%. Läuft nach Plan. ?

Habe meine Calls auf Gold verkauft - der Preis kommt gerade deutlich runter.