Disney’s (DIS - Free Report) streaming service Disney+, which was launched on Nov 12, 2019, reportedly continues to witness strong user growth two months after its debut.

Per Sensor Tower data, the streaming service’s mobile app — which has been downloaded nearly 41 million times across the App Store and Google Play — witnessed an estimated $97.2 million in user spending.

The company itself announced 10 million Disney+ sign-ups a day after its debut. The media giant will give its next subscriber update with first-quarter earnings on Feb 4, 2020.

https://www.zacks.com/stock/news/719114/disney-dis-benefits-from-strong-demand-for-disney-service

Exiting Thermal Coal Producers - Thermal coal production is one such sector. Thermal coal is significantly carbon intensive, becoming less and less economically viable, and highly exposed to regulation because of its environmental impacts. With the acceleration of the global energy transition, we do not believe that the long-term economic or investment rationale justifies continued investment in this sector. As a result, we are in the process of removing from our discretionary active investment portfolios the public securities (both debt and equity) of companies that generate more than 25% of their revenues from thermal coal production, which we aim to accomplish by the middle of 2020. As part of our process of evaluating sectors with high ESG risk, we will also closely scrutinize other businesses that are heavily reliant on thermal coal as an input, in order to understand whether they are effectively transitioning away from this reliance. In addition, BlackRock’s alternatives business will make no future direct investments in companies that generate more than 25% of their revenues from thermal coal production.

was nen ökospinner, dieser larry fink...

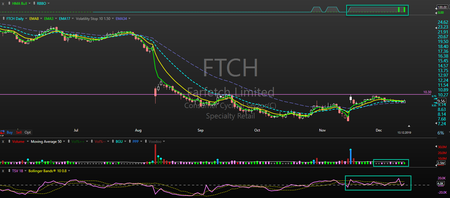

FTCH mit Voodoo. rounded-bottom BO und HMA Bull, TSV mit growing demand -> Watch resistance!

Farfetch: Ready To Turn The Corner

FTCH schlägt gerade gegen den Deckel!

Öfters auf FTCH verwiesen, nach kleiner Base jetzt an der Eisfläche. Könnte bis zum gap-close laufen.

Exiting Thermal Coal Producers - Thermal coal production is one such sector. Thermal coal is significantly carbon intensive, becoming less and less economically viable, and highly exposed to regulation because of its environmental impacts. With the acceleration of the global energy transition, we do not believe that the long-term economic or investment rationale justifies continued investment in this sector. As a result, we are in the process of removing from our discretionary active investment portfolios the public securities (both debt and equity) of companies that generate more than 25% of their revenues from thermal coal production, which we aim to accomplish by the middle of 2020. As part of our process of evaluating sectors with high ESG risk, we will also closely scrutinize other businesses that are heavily reliant on thermal coal as an input, in order to understand whether they are effectively transitioning away from this reliance. In addition, BlackRock’s alternatives business will make no future direct investments in companies that generate more than 25% of their revenues from thermal coal production.

was nen ökospinner, dieser larry fink...

Warum? Was stoert dich daran?

DHER Delivery Hero mit KE! https://www.dgap.de/dgap/News/adhoc/delivery-hero-kuendigt-ausgabe-von-wandelschuldverschreibung-und-barkapitalerhoehung-an/?newsID=1259213

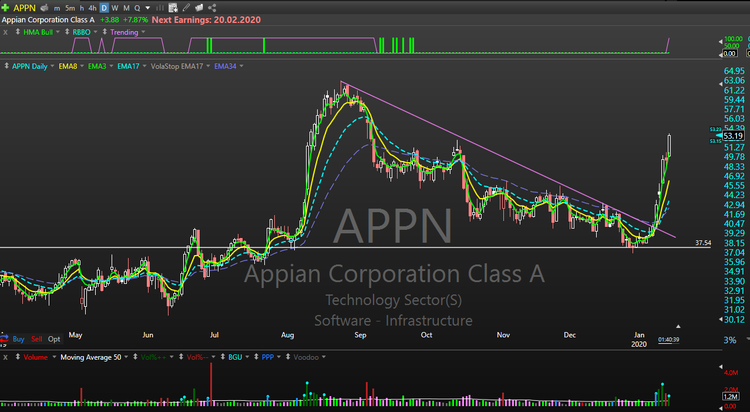

APPN Gestern mit Undercut, Heute erste Kratzer an der Trendline -> Watch Up/Down Trendline

APPN the sky is the limit...

Exiting Thermal Coal Producers - Thermal coal production is one such sector. Thermal coal is significantly carbon intensive, becoming less and less economically viable, and highly exposed to regulation because of its environmental impacts. With the acceleration of the global energy transition, we do not believe that the long-term economic or investment rationale justifies continued investment in this sector. As a result, we are in the process of removing from our discretionary active investment portfolios the public securities (both debt and equity) of companies that generate more than 25% of their revenues from thermal coal production, which we aim to accomplish by the middle of 2020. As part of our process of evaluating sectors with high ESG risk, we will also closely scrutinize other businesses that are heavily reliant on thermal coal as an input, in order to understand whether they are effectively transitioning away from this reliance. In addition, BlackRock’s alternatives business will make no future direct investments in companies that generate more than 25% of their revenues from thermal coal production.

was nen ökospinner, dieser larry fink...

Warum? Was stoert dich daran?

keine sorge, ich find das super. war nur vorher im persiflage-modus {pear}:nerd:

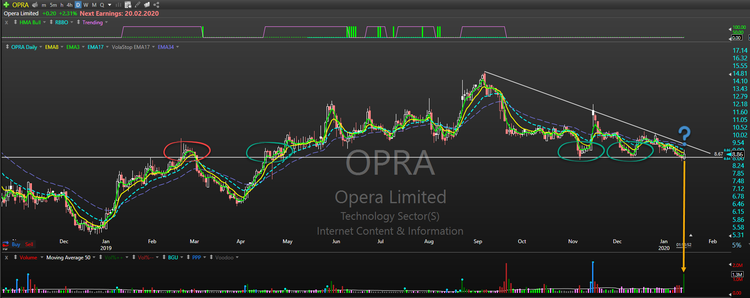

OPRA jetzt mit mehrfach Boden. Volumen seeeeeehr auffällig!

Opera erobert die Emerging Markets im Sturm